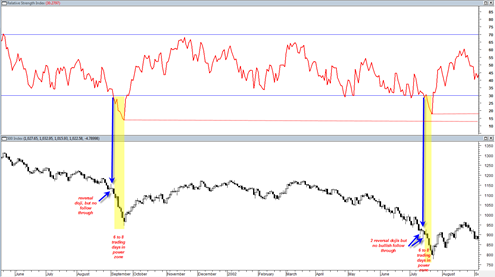

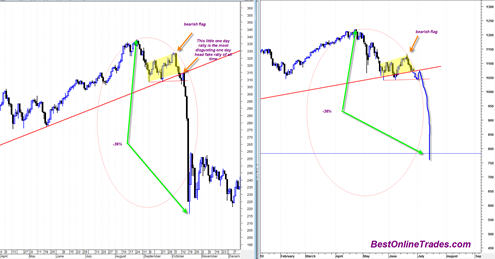

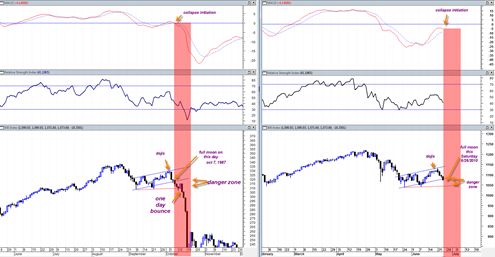

My sense is that we are at the end game during the next two weeks, the final stage of what I think will be a mega crash. I sense this from my extended observations of the 1987 price chart versus the 2010 price chart. The structures are so similar it is not even funny.

Just to sum up some of the reasons why I believe a mega crash is likely to occur:

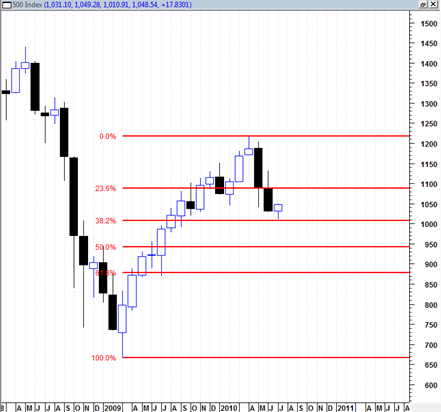

- The rally since the March 2009 lows was a low volume manipulated rally by government interests. Markets can only be manipulated for brief periods of time but ultimately they tend to resume to where they were trending before the manipulation and reflect real economic realities again.

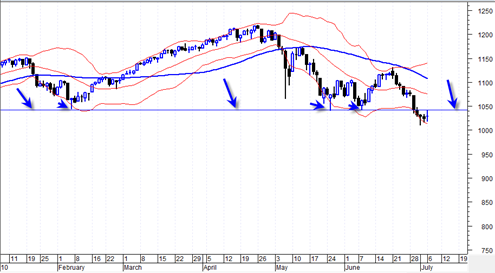

- The market right now is cranky, in a bad mood, and has a bad looking nervous tape. That is not the type of action you like to see for new bull trends.

- The rally from the March 2009 lows was arguably an ‘automatic rally’ given the nature of the severe plunge into 2008. The downside follow through after automatic rallies are complete in my observation has many times led to crashes (at least in individual stocks).

- IF we are really about to enter a massive deflationary economic spiral it is not uncommon for the market to signal this fact with some type of ‘shock and awe’ campaign. A big crash would do the job and signal to the world that the market has started to price in a zero growth deflationary environment. The market may suddenly start to build in price to earnings ratios of 1 to 5 instead of 15 to 20.

- The Jobs Killer

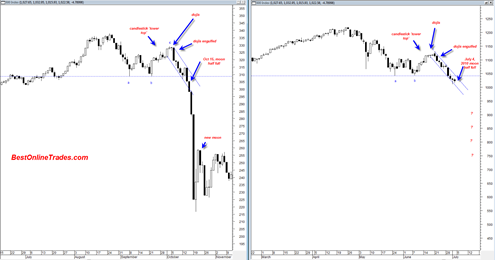

- The pattern similarity to 1987

- The Astro Cardinal climax aspects which kicked in late June and seem to be exerting some serious downside pressure on the market now.

- Almost no one is calling for a devastating rock bottom crash where prices go down and STAY DOWN. Actually this is not entirely true. Richard Russell has been talking about a crash as well as Bill Mclaren. Bob Prechter is bearish and looking for much lower prices but I have not heard him specifically talking about a huge down move happening in the next couple of weeks. Perhaps he has for his paid subscribers (see elliottwave links on left sidebar). There have been plenty of more underground type sites and blogs looking for a crash however, but not too many mainstream sources from what I have observed.

I have spent many many hours staring at and studying the nuances of the 1987 topping pattern as compared to our current topping pattern. The pattern similarity is strikingly similar. The candlesticks and engulfing patterns are similar. And the final act, the subtly down sloping decline leading to a vertical decline is also similar. We are situated right now in the subtly down sloping decline. The most important question now is, do we transfer into a persistent vertical decline as 87 did. The time similarity is what is missing. The 2010 pattern is taking longer to form and this may or may not destroy the correlation.