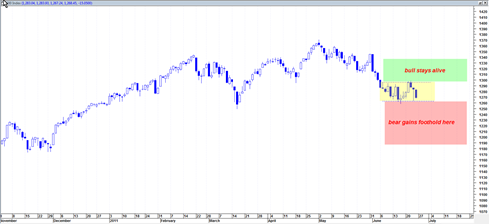

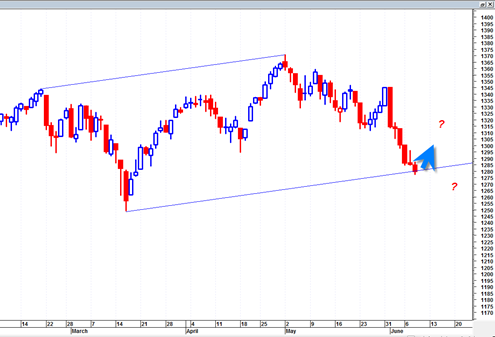

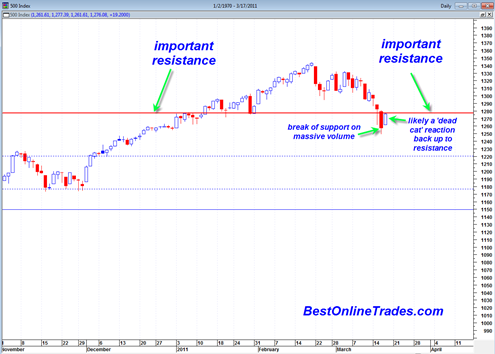

What is the verdict? The sp500 has for the last couple of weeks been trading in a rectangle formation with bit moves to the upside and big moves to the downside. Add up one big up move minus one big down move and the net result is zero progress. Or is it?

Well it is progress towards an eventual outcome that will either be bearish or bullish.

The Bullish Case

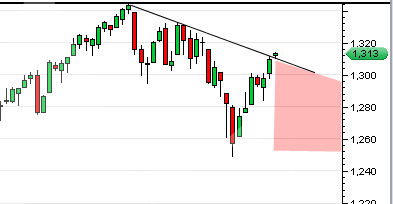

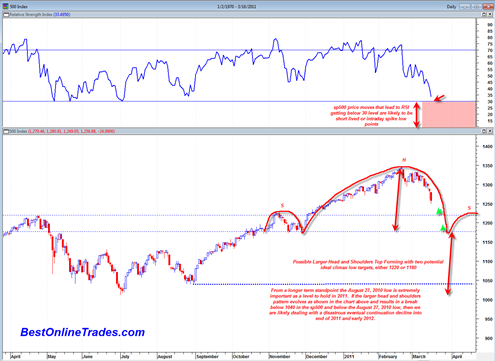

The bullish interpretation is that the current trading rectangle formation is a pausing point of the recent mini bear and then a reversal point where prices consolidate and then bust out north from the rectangle.

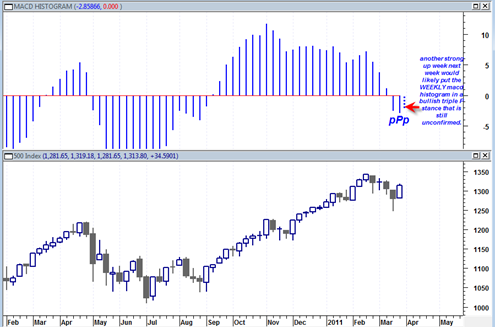

The bullish interpretation is currently supported by the fact that the recent mini foundation of price work is on a lower relative volume than occurred on the SPY in mid March 2011. That would seem to support the case that the current rectangle is serving as a pause point and reversal point.