The bullishness is simply astounding lately. It is remarkable. Undeniable at this point. It seems like we are up almost every Monday of the week, every Friday of the week and most days in between.

So that must mean we are overbought and ready for an extended nasty decline that will be horrible and scary right ?

Not necessarily.

Yes sentiment is at extremes, technical indicators are at extremes and it really does feel like at least a minor or intermediate pullback is way overdue. But my take going forward continues to be that the market will keep trying to frustrate the heck out of those who wish to short it.

I tried to short this market several times since October 2009 and most of those attempts failed. The only one that succeeded was the one in October 2009. I was lucky to catch that mini decline. But all the other attempts failed.

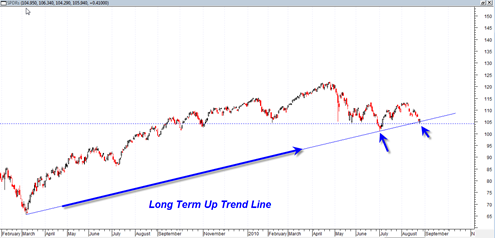

Why did they fail? They failed because the primary trend is still very strongly up and in that type of environment every pullback is generally weak and the strong upward trend is eager to reassert itself.

The issue now is what should your general 1 to 2 year trading bias be? Is it even possible to have that long a forecast? Generally speaking the farther you go out in terms of time, the more difficult it is to get a handle on potential price bias.

Unless…

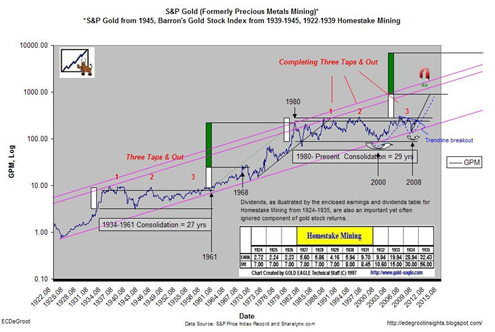

Unless you have some very large patterns to work with or some other major market clues ( such as foreign indices or commodities ).