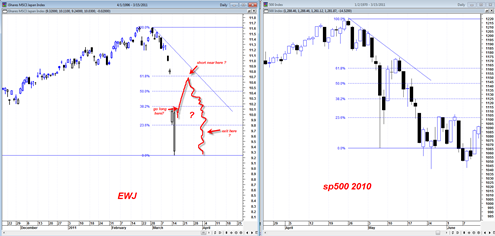

There was a huge huge trade that I missed today unfortunately and also was not quick enough to write about it. The trade was going long the EWJ (Japanese Nikkei ETF) right near the open today.

The EWJ opened down in crash fashion because of the overnight drop in Nikkei Futures. The opening in the EWJ ETF was so extreme that it had the daily RSI at a record record low point perhaps near a value of 10 RSI, not only that but the EWJ also opened right at a strong level of support from the June July 2010 time frame. This morning was a huge opportunity to go either long the EWJ or long some March or April call options on the EWJ for potential 100% to 500% profits by the end of day.

Certainly based on the news it would have appeared that the EWJ was an extremely high risk trade with the nuclear and earthquake fears, but in actuality this is one of the lowest risk trades one can take in my opinion.

You had washout blow out panic volume, massive oversold RSI and opening right near an important support range.

I think it is quite fair to describe the recent 5 day move in the Japanese Nikkei index a crash in terms of the speed and magnitude of the decline.

So the lowest risk trade was near the open today, but there may still be a chance to trade the EWJ as it is now still in a very high volatility cycle and we should see huge swings in both directions. But I would say that now the trade becomes much more dangerous compared to this morning’s trade.