After letting the market action ‘soak in’ after the last two days I am coming to the conclusion that we will see two possible scenarios next week.

The first one is that we do not head down immediately next week or even mid week and instead tread water slightly higher or even into a new very marginal minor high that exceeds the 5/13/2010 price swing high. This type of range bound trading action could take the shape of a symmetrical triangle formation that coils up the price action into a spring that breaks either end of this upcoming week or into next week.

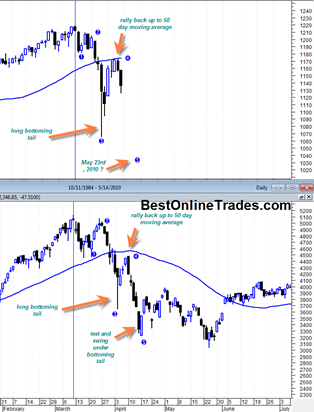

The second scenario is that the market simply falls apart in a series of cascading declines into end of this week, or perhaps into the May 23, 2010 date. This is currently my favored and gut feel scenario that will play out. One of the reasons I am favoring this scenario is because of the heavy downside Friday volume. It was not blow out volume but it was enough for me to sense that it could build into a climax volume with more price destruction.

Also the Euro is in a stance where it could spike lower and gold could spike higher to 1300 to 1400 an ounce in a matter of days. If you look carefully at the Euro, Gold and the stock market, it paints a picture of some type of climax type move this week or next.