There has been a lot of ‘chatter’ lately about how the gold price may be at a major top. I keep looking at the GLD price chart since October of 2010 and have been trying to come to a bearish conclusion but am having a hard time doing so.

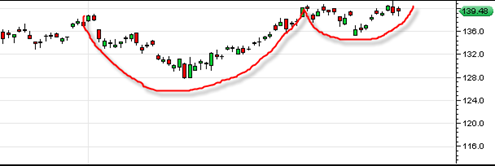

It is clear that the GLD has shown a struggling attempt to make new all time highs from the period October 2010 to end of year 2010. The pattern resembles the somewhat common ‘three drives to a top’ pattern that is occasionally seen in stocks and indices. But this topping pattern seems to have failed. During January 2011 we saw the GLD break down, looking like it wanted to confirm the three drives to a top pattern, but then afterwards we saw the GLD take off yet again pushing into life time highs again (into early March 2011) but only for a brief period.

My take is that this most recent push into life time highs again, even though they were only marginal new lifetime highs, should not have occurred if the GLD was in a very bearish pattern.

Instead the GLD now appears to have a cup and handle formation with 152 as the projected target (roughly 1520 gold price).