BestOnlineTrades is issuing this blockbuster trade alert on the gold sector. Whether it be Gold Futures, Gold ETFS (such as the GLD or DGP ETF), micro cap through large cap gold stocks, or even long dated call options, we believe the gold trade will be the most popular and productive trade for the next 9 to 12 months.

This is a very important alert and we feel that this alert may go down in history as being the most valuable and important alert we have ever issued.

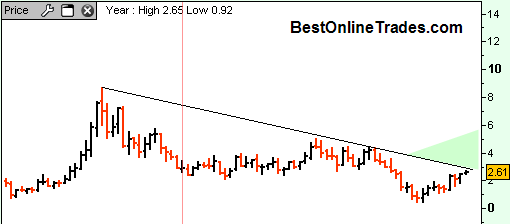

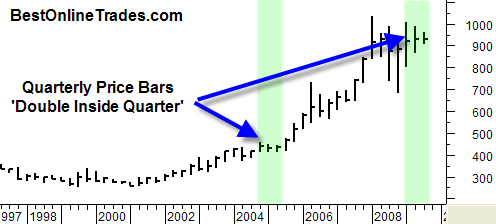

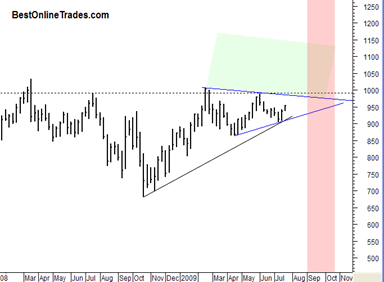

BestOnlineTrades has studied the gold market carefully since 2003. We have seen and recognized the beginnings of this bull market at that time and feel that right now, perhaps even as soon as this week the gold trade will activate and turn into one of the biggest breakouts the world has ever seen. It may not seem like a breakout at first, and it may disguise itself by transforming into a ‘slow motion’ breakout, but we believe it will still be seen in hindsight as being transformational.

While we do not talk too much about fundamentals here at BestOnlineTrades, we remain open to the possibility that inflationary trends will start to become more entrenched and severe during the next 9 to 12 months. Part of the reason for this observation has to do with the fact that the US Dollar Index precisely aligned and topped with the April 21st, 2009 Marty Armstrong Cycle date precisely. The Marty Armstrong Cycle is a very powerful 8.6 year global business cycle model that has proven itself to pick extremely important turning points in major markets worldwide. The fact that the US Dollar has aligned itself to the model is an event in our opinion that is not to be taken lightly.

Read more