The SP500 closed right near the highs today but the volume was lousy. I have to say this is a pretty amazing accomplishment given that it is a lazy Friday right before a 3 day holiday weekend.

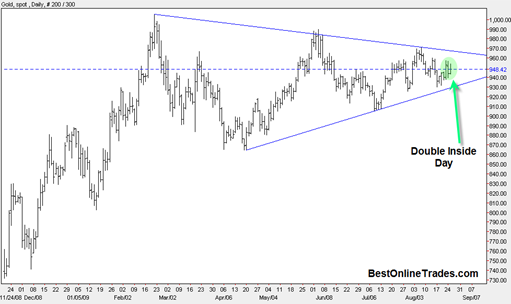

The gold price also barely pulled back today and managed to close slightly positive on the daily basis. This is a very bullish sign on a near term basis and says to me that the gold market could get some significant continuation next week. The longer we hug the recent highs without pulling back that much, the more bullish potential we have for the long awaited break over 1000 !

But there is talk that the broad market is supposed to tank big time next week. I can see this as a possibility when I consider the huge downside volume that we had 3 days ago in a serious sign of weakness. Yes we bounced higher today and closed right at the highs but it was on barely any volume. It was all smoke and mirrors.

But I do have to respect the fact that we bounced off of support and now are bouncing back topside. It just seems like the bears should have been able to accomplish more downside this week but they couldn’t get it done. If they can’ t get it done next week then it could very well be that we are headed for more super bullish upside prices. In a previous more longer term post on the sp500 I mentioned a scenario where this could be possible.

If this market is going to get a serious downside correction then I would think we get a gap down on Tuesday in the AM and then just slide down from there. If we are still drifting around next week, then I am going to become more and more skeptical of the ‘super duper correction’ in September scenario.