Gold is getting hit bad today and if you look at the dollar amount on kitco.com it looks a lot worse than if you just focus on the price chart. The GLD ETF was overdue for some type of consolidation and using the employment report news today seemed like a good enough excuse for the big money crowd to slam it down.

Right now my take is that we are going to enter some type of sideways consolidation perhaps a month long before going higher again. I say that because I think today’s price destruction in the GLD combined with the huge volume should be enough damage to start a trend change/ and or consolidation.

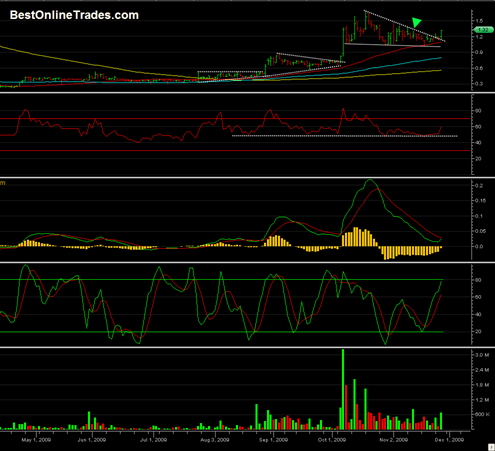

The chart above is the GLD ETF in the 2007 to 2008 time frame. The red arrows point to heavy selling days that damaged the up trend enough to get the GLD into consolidation mode for a while. So I am expecting something similar to what occurred in the chart above.