For months on end there has been lots of bashing and negativity on the financial stocks. Uncertainty and fear and anger over the unjust billions lost and sloshing around in that sector has turned a lot of mainstream opinion quite negative on this sector.

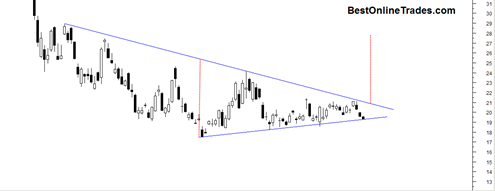

From many trader’s perspectives I believe this was also the case. For every positive story I read or heard on the financials stocks it seems there were at least 4 that were negative in terms of fundamentals or technicals. I must admit I also have had a bearish take on the large and somewhat lengthy broadening topping pattern in the XLF financials ETF.

It was hard to get bullish on this large pattern because it seemed to be not only a rounding topping pattern but also a very bearish broadening topping pattern. I tried shorting the XLF a couple times towards the end of 2009 with very meager results. I remember sitting in those trades all excited about a huge expected break down. But then I also remember total frustration at how the XLF time and time again just would not break support or get enough selling power to cause some real trend breaking type moves.