I suspect that a big move is coming in the gold price and the GLD ETF (SPDR Gold Trust). Today gold behaved extremely well in the face of the first general stock market decline in over a month.

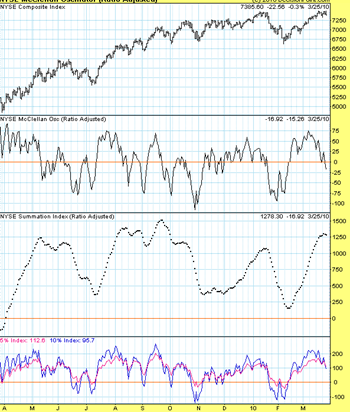

It could very well be that the gold price will begin to trade with relative strength to the stock market as the stock market is extremely overbought right now. In fact I would not be surprised to see the stock market start to head south for the long awaited correction and then see the gold price zoom higher totally ignoring what the stock market does and even using a decline in paper assets as more fuel to the fire.

The daily and weekly charts on the gold price look outstanding and I continue to believe that right now…

Gold and Gold Shares are Much Better Risk Reward than the General Stock Market right now!

The reason for this is simple. Gold has been in a corrective phase since early December 2009. This is a long time by trading standards no matter what security or index we are talking about. This consolidation time for gold has put it in a position to head higher regardless whether or not stocks keep going up or start a correction now.

The gold price has led the way in breaking out to new all time highs and the stock market has LAGGED the way trying to catch up to the gold price but so far not even coming close to achieving it.