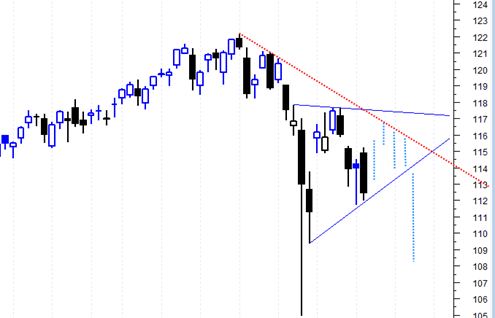

The wild volatility over the last 2 weeks I think had a lot of people probably feeling like they just entered the spin cycle in a washing machine. The market was showing huge signs of strength and then equally huge signs of weakness back and forth. In the final analysis I think we can basically say that the last two weeks the market has basically traded flat.

But a market that trades flat still means something. It means the market has created sideways cause ( or energy) for the next big move. It looks more and more like that next move is going to be down in a new panic cycle.

I can give you plenty of reasons why the market could still get a bounce to the 1100 to 1150 range but so far it has already tried to bounce above the 1100 and has failed. It may try again (especially considering the extremely heavy oversold closing Arms value we has on 6/4/2010) but my instinct tells me it will just engage a new panic cycle starting tomorrow.

If you look at the 2/10/2009 date you will see a similar market basing period that looks quite similar to the period we are in now. Also notable is that on that 2/10/2009 there was a similar very high closing ARMS value but not nearly as high as 6/4/2010.