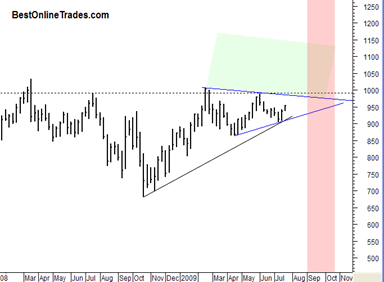

Ok well I am a bit disappointed in the way UNG played out. UNG stopped out today right at the close at 12.90 for a loss of 7.06%. I suppose it is better to be stopped out right at the close of the day than to sit on something like UNG overnight. This was a violent in your face reversal. Wow. The chart above shows a clear birds eye view of what is going on with UNG.

The left side of the chart is monthly price bars. You do not have to know much about technical analysis to know that this chart depicts a crashing price and severe price weakness. But the interesting part is the most recent monthly price bar that has a little yellow arrow pointing at it.