In my previous posting I put forward a mini trivia question on a portion of price action in the sp500 that shows what appears to be a bullish inverse head and shoulders pattern. But is it really bullish?

I have pointed out in some past posts that inverse head and shoulder patterns that form near the very top of a market advance are probably less favorable than inverse h&s patterns that form after an extended market decline. I do not have statistics to back that up, but it seems like a natural conclusion simply from a risk reward standpoint where price is trading in the phases of a trading cycle.

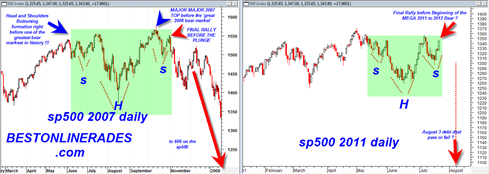

So the answer to the trivia question is JUNE TO OCTOBER 2007. What is important about June to to October 2007 ??? This period was the final top of the period 2007 and right after the inverse head and shoulders pattern completed the market went onto dive into one of the greatest most devastating bear markets in market history.

Curiously we now have another inverse head and shoulders bottom in the sp500 in the 2011 time frame with a debt deal as an apparent deadline for market deciding type action. It would seem we are at almost the same juncture in terms of pattern similarity.

So does the debt deal get passed and the DJIA blast up 500 points and keep the bullish scenario going ? or does the market top out very similar to 2007 and then start another long devastating bear into 2011 and 2012 ?

I wish I had a specific answer, but the chart below shows the setup and the potential for us to be at an extreme bearish type top.

I think bulls need to be careful about being arrogant in the current time frame about bullish prospects for the sp500. Yes a bullish scenario exists and could evolve into August and September 2011 but there is still a % chance of a mega bear developing from the very near term time frame. The MONTHLY chart is what has kept me open minded to a MEGA BEAR scenario.

I can tell you with ZERO DOUBT that if the right portion of the chart above starts to play out like the 2007 top then BestOnlineTrades will switch to BOT SHORT and STAY BOT short for a long time.

What is so fascinating about the 2007 chart is that the market transformed into one of the worst bear markets in all of market history right AFTER the inverse head and shoulder pattern was completed!!! (big red arrow on left portion of chart above).

Is it fair to make a comparison to the 2007 top to the current 2011 trading range ? Not exactly. The monthly MACD in November 2007 was right at a bearish crossover point. Currently the market is showing that the monthly MACD is not at the bearish crossover point, BUT very devastating and bearish price action in AUGUST 2011 could really help the monthly MACD turn DOWN hard.

interesting point made. the 2007 HS took, what seems, 5 months to play out / get in position. this 2011 potential version seems to be getting in position in only 3 months, AND if this hypothesis is valid, i presume that the market can NOT go any higher than it where it is now. ummmm, i am not sure that will happen, e.g., i think the market unfortunately will go higher. “pug” says to 1440 by late Oct and than we start down.

these analyses that take old historic patterns and try to overlay them on current history, i find interesting but the market seldom seem to “play out” as the writer implies it might – – not just this blogger but many many others.

having said the aforementioned, i think that any unpredictable event could really rock the markets globally – – e.g., another strong earthquake, volcano, famine, drought, pestilence, or other large act of the Almighty or children of the Almighty, e.g. Israel attacking Iran or other conflagration in the Middle East

it is extremely curious to me, why this blogger puts forward this hypothesis and yet moves his market call from Bot Short to Neutral.

I find it very perplexing, and quite inconsistent. If his analogy to 2007 is correct than the market should start down very shortly. Very shortly. It only makes me believe that the blogger has little confidence in his own analysis. If he has little confidence in his analysis, why should his readership? ? ? ? ? ?

what the heck happened to the ballyhooed “Cheetah System”?

What is wrong with being at a neutral stance while the tape is watched to see if it confirms a possibly massive massive topping formation?

If I switch to BOT Short right now, and then the market rallies another 50 to 100 sp500 points I will get pooh poohed for making a horrible call etc etc.

Staying in a neutral stance and waiting for the expected failure seems much more reasonable mind set at this point especially in the current volatility.

In fact, thinking back it would probably be better to be in a neutral stance most of the time and then only occasionally issue the bot short or long signals… more flexible that way and better chance at capturing the market at the right moment.

Going back to the yearly charts (probably the most dependable) we can see that we are very close to breaking up through the downward trend line

We may bounce off it but even if we don’t, I still favor my original “gut theory” of a Falling Three Methods bearish candlestick pattern that will lead to an over the waterfall type downdraft in 2012

http://www.bestonlinetrades.com/wp-content/uploads/2011/06/sp50020110623.png

sorry Tom – – i guess you just can not “win” with me, until you start winning. i think where i am coming from is that your commentary frequently is “breathless” and written as if what is about to happen is of “biblical” proportions and ordained to happen. the writing may initially attract an audience, but at some point, the writing has to realistically portray what transpires.

if you are write that this potential inverse HS will break down than it MUST break down almost immediately or, if i understand, than the market must go NO higher – – otherwise a higher market from here would not fit the pattern of 2007

Geoff:

In the June 21 blog titled “Inverse H & S Seems to be Working…: ” I made a comment addressed primarily to you.