Today I have to initiate the BOT long signal again on the sp500. The market has spoken and appears to be in absolutely no mood for more bearish price action at this time.

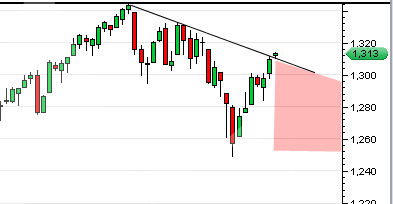

Currently the sp500 is trading slightly above its ‘mini bear’ down trend line and as long as price holds above this line today (and stays out of the red shaded area below) then the signal is still active. I expect there to be some resistance at 1332 at which point we would likely see some selling pressure kick in again and that may then form a right shoulder of a head and shoulder bottom formation.

The revised GDP number today was certainly not a blow out number but it was not extremely disappointing either and that seems to be good enough for the market at this time.

The sp500 continues the pattern of using any slight decline as fuel for a new move up. The decline gets the indicators into oversold mode and the market pounces on them as an opportunity to push them into overbought again. This pattern has been in force for a long time now. Will it ever end? Of course it will, but when is the key question…

As I mentioned EW predicted this exact market action. We are now approaching the area where I projected the completion of the c wave up. That is the black box containment roughly SPX 1308-16.

The market should hold here and then start its correction.

I suggested that EW would indicate a correction on the SPX of somewhere around 100 points, althogh it could be greater.

I am closing all my long stocks today and am preparing Monday AM, to start shorting. Of course that is assuming that the market does not go much higher than 1319.

Tom, I really think this is a bad time to initiate a BOT long signal.

Good luck, too bad we both can not be right.

Hey Guys.

Tom,

In my opinion, we will see SPX at 1270 range early next week then back up. I dont think we will see the 100 pts down as JR is referring to but bot long would not be a good choice early next week. As it appears now, we will be range trading for the next few months 1270’s to 1320’s. Sept will start the next big run.

The analysts predicted a 11% gain for the indexes for the remainder of the year. Since they are the ones with the cash and insider trading…I would have to go with that.

Good luck next week…I will be out.

Hmmm, well certainly you could be right. I jumped to the bot long signal because we busted above the short term down trend line and a few other reasons…

But I do have to admit that today’s upward break through down trend resistance was not exactly a sign of strength or a wide price spread. It was quite a lame upside move and so it could be a complete head fake and indication that the down trend will resume again early next week.

If we get a bad down day on Monday, then it may set up a Histogram sell confirm for Tuesday depending on what Tuesday does… so lets see how it shakes out…

The other non technical issue that may be at play and which I forgot to mention in the postings is that we have end of quarter window dressing into the end of the quarter.. maybe it will not work this time though, we will just have to wait and see..

I still think there is an outside chance of 1332 on the sp500 before any more meaningful drop again but I could be wrong..

1270 makes a lot of good sense also Larry since it would make a higher low, but what does not make sense in that scenario is that the mini bear down trend line would be breached again which would damage the near term bullish outlook..

The last 4 days of the quarter will surely be interesting…

Lets see if there is any follow through early next week or a big drop…

IMO todays candles are reversal candles. EDZ, TZA & SPX all have reversal candles on the daily. What I am seeing are patterns on the daily charts. Look at ANN, you will see a cross on the daily SMA 21, 55. The cross occurs after a hefty downfall, the stock comes back to the 55 then drops again within the bollies, hoovers around the downside for a few weeks. Then the stock(indexes)comes back up forming yet another cross on the SMA 21, 55 to the upside. There are quite a few stocks(JDSU, CIEN) that have that same daily setup. I feel that the indexes are following suit and will have an upside towards the end of summer into fall timeframe.

The boolies have set themselves(top and bottom on SPX) and I dont think the bottom bollie will be breached at the next lowest downturn.

On further reflection, I concur on a short term BOT at least through April 2.

The retrace on SPX and DOW was just too high.

i appreciate the courage it takes to put opinions on this site, but i find the site almost perfectly contrary to what eventually actually happens. my opinion for the final trading wk of March is we go down. as they “say” – – glta but all will not have gl

There is always a bull and a bear side and all opinions should be considered, that is what makes a market. But why do you believe the last week of March has to be down? I remember before you did a post (a long time ago) about how there is no way the market can go down in end of quarter window dressing (i forget what month it was maybe 2010 some month).

So now we have end of quarter and end of month window dressing and you think market will go down…

Maybe it will go down, but I am starting to think that this market just declined on the earthquake in Japan and the Middle East… in the meantime Europe is imploding and the US Government is about to be shut down… As crazy as it sounds, these could all be reasons for stocks to go up…

I am borrowing that thought from Marty Armstrong… Capital is taking flight from government and shifting into equities, this may be the larger trend we are seeing happen time and time again as we move into 2012.