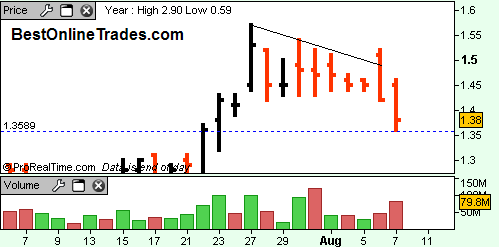

If the gold price is going to get a breakout going out of this large symmetrical triangle into the typically strong seasonal time period of mid-September, then it needs to hold above the blue trendline drawn above. It needs to remain above this blue trendline for the next month or so if an accelerated breakout scenario is to take place.

It would be an ideal situation for a breakout out of this symmetrical triangle because going too much further into the apex of the triangle could possible weaken any potential breakout.

I have labeled minor support along that blue up trendline as 92.18 on the chart of the GLD ETF above. I would expect at least a one day bounce after touching that line. A break under it would invalidate the near term breakout scenario and open the door to a move back down to the bottom portion of the triangle.