I hate to turn BestOnlineTrades into a ‘one trick pony’ for the next couple of weeks, but I may spend a lot of time covering CTIC Cell Therapeutics in a multi part series. I will still cover some other topics as well, but I would rather focus in like a laser on CTIC and see what can be learned about its behavior and possible outcomes.

The chart of CTIC is notable for several reasons. It clearly has a solid uptrend with very respectable advancing volume since the March 2009 time frame. So it has shown us a clear sign of strength off of a major bear market bottom. This is important because it helps to give added probability for possible future price direction.

Also notable is the fact that CTIC has consolidated sideways for roughly 3 and a half months AND it has not given back too much in the way of price. In other words, price has held relatively firm during the consolidation instead of slanting down or going into a deeper retracement.

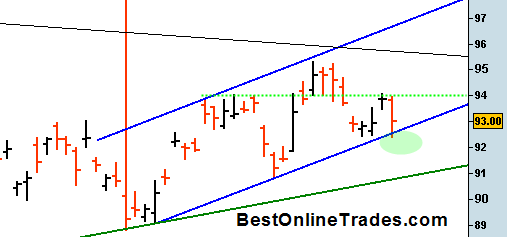

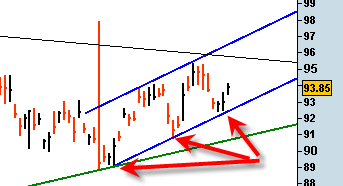

The SPDR Gold Trust (ETF) GLD was able to get a nice bounce going today off of blue trendline and channel support.

The SPDR Gold Trust (ETF) GLD was able to get a nice bounce going today off of blue trendline and channel support.