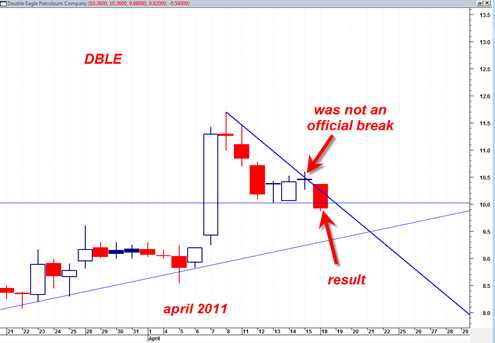

DBLE, the second trade of the Cheetah Trading System seems to be performing well after two days of draw down after entering the trade. Yesterday 4/21/2011 DBLE had a pull back on 75% less volume and as a plus managed to avoid exceeding the 4/20/2011 high by one penny. This is good because I like to see strong volume contraction on pull back days without touching the previous days high. In this case DBLE managed to avoid doing so by one penny.

DBLE is not really a ‘big pattern’. But I only recently decided to focus this first Cheetah trading system on big patterns. So I am stuck with DBLE for now and if all works according to plan will hope to exit DBLE in the 12 to 13 range?

If I can get an exit on DBLE within the next month or two, I would then like to consider a long entry in TLR, a possible big pattern I have been watching. Ideally TLR will wait for me until the DBLE trade is finished.

TLR is a highly speculative gold exploration company with transitional potential to a production company by early 2012. I have spotted TLR as a potential big pattern and will now start to study it like a cheetah in the tall grasses.

I probably do not have to inform you that the gold price has been hitting record life time highs and will maybe continue to do so for a while longer.