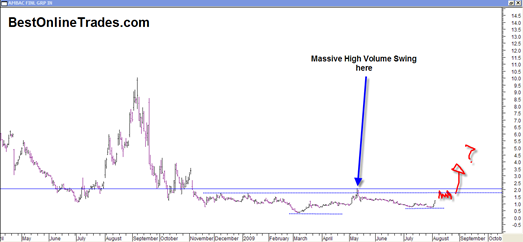

ABK Ambac Financial also came up in my new scan that I developed yesterday and also showed up in the MarketClub Scan. As I just indicated in my previous post, the real estate sector is starting to rise from the dead a little bit and so this sector may be worth paying attention to.

I was lucky enough to play ABK Ambac Financial way back in August of 2008 after it had a massive bear market rally from a dollar and change to almost 10 dollars. I remember it vividly because I was on vacation in Cape Cod up at the Eastham cottages and I remember trying to manage this trade with my laptop using the hotels wireless connection they had in the lobby. I would go there every morning and then in the afternoons trying to engineer the Ambac trade. At the time it was consolidating in mid August (see chart full size by clicking on it above) in a somewhat ascending triangle or symmetrical triangle pattern. But I was stopped out several times and then had to re enter for the eventual move to 9 and change. I had to be real careful about getting into Ambac because the stock had already had a big move and I was not in the trade right off the bottom, so I was unsure whether it had enough steam to go higher.

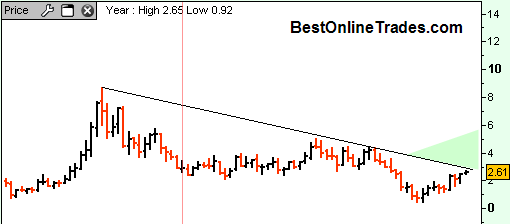

After a violent retesting action in the UNG ETF I believe that UNG has now bottomed and should embark on an eventual retest of the 17.55 level.

After a violent retesting action in the UNG ETF I believe that UNG has now bottomed and should embark on an eventual retest of the 17.55 level.