Chart Source: MarketClub

Chart Source: MarketClub

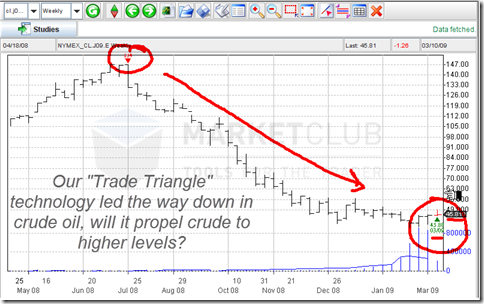

Adam Hewison from ino dot com made a great video about crude oil recently and makes a few interesting points about the crude oil market going forward that are worth listening to.

You remember me talking about the long position in DXO (the double crude oil long) that I entered earlier? By the way I am still in that position but realize I may have to deal with some left over choppiness in the crude oil trading action near term. However it still looks good for an upside bounce, and maybe a major upside bounce? How major? Well Adam talks about the fibonacci retrace levels in his video since this market topped out in July of 2008.

The truth is that a reasonable normal fibonacci retracement of this entire down leg in crude oil should put it somewhere near 70. That equates to about 5 or 6 for the DXO ETF.

But when will it get there?

Predicting time targets is very difficult, but if I had to guess I would say it could get there by the latest the July time frame, and then come back down into a more longer complex type correction that sees crude oil basing out.

The issue is we just want to try to get that initial JUICE out of a ripe orange, know what I mean? What happens after that is really irrelevant for now.

Oh yea, one other thing I forgot. It is time to start paying attention to the US dollar Index. I believe it may have topped, and topped in such a way that many longs could be trapped in it. All I can say is that when it comes to the US Dollar, don’t dip your hand in that cookie jar too many times or you may have some nasty surprises after that.

It looks like the US Dollar Index may have formed a marginal new high but then closed back under the trading range. That is a similar type of setup that the Dow Jones Industrial Average did during the 2007 highs! It trapped everybody up there and then took then down fast for a beating.

Why am I mentioning the US Dollar Index???

Because if we get a severe correction for the next 30 days which is starting to look likely, that would be the PERFECT fuel this crude oil market needs to get a spike UP retracement rally.

I am pretty confident in this setup but we will have to see how it pans out. Everything seems to be coming together now.

One last point about Adam Hewisons video… I agree with everything he says, the only thing I do not agree with is that a rising crude oil price will right away cause problems for the stock market. I believe the stock market will go up now even if crude continues higher for the simple reason that the stock market also loves a weak dollar which is inflationary. Now eventually the stock market may get stuck in a stagflation but for now I think all of them could go up since they are all so oversold.