Today’s action in the sp500 has me thinking the 8.6 year cycle model turning point I have been talking about ad nauseam for months now is starting to take effect and turn this beast of a market into a sideways to down market.

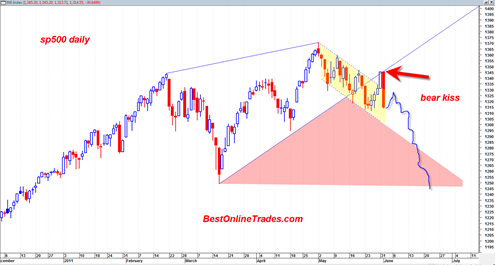

Today we saw the sp500 blast back under the tight channel I have been referring to and did so on robust volume on the SPY ETF. This was very bearish action today. The breakout from the channel yesterday was false. The market re asserted itself to a bearish trend today. This should keep the weekly bearish trend going again and continue to manifest the possible weak or weakening monthly trend.

I think it quite possible that we are at a very important top in the market here. It is no coincidence that this turn action is occurring only a week or two from the June 13, 2011 cycle model turning point.

In yesterday’s post I pointed out a very large possible structure on the Dow Jones Transportation Average that could take the shape of a massive head and shoulders bottoming formation. If true then we could see some hefty declines in this index to create the right shoulder of the pattern.

Even if we are at a major top here in the sp500 I expect it to be choppy. Tops take long to form and are messy at the top. Just look at the 2007 top and how long it took to fall apart.

I will be looking to start a BOT short signal on any type of rally later this week, or on a break below 1313 in the sp500.

Key also today was that we did a meeting lines candlestick formation where the open today was the same value as the close of yesterday. Then we reversed and closed at the lows. Very bearish.

Also key was that we closed under the Feb. 18, 2011 swing high and were not able to exceed it.

I think the short side has a bias pretty soon but I expect things to be still quite choppy. It will be interesting to see how fast the market loses price support, this is going to be the real key in determining how significant a top this potentially is right now.

It is looking a lot more probable to me now that we are going to get to the mid March 2011 very high volume swing low and test it.

The MONTHLY MACD is starting to curl down ever so slowly. I think we are in the early phases of a major trend change now. It is probably still not a good time for any ‘easy shorts’. It is MUCH too early for that still I think.

The red shaded area in the chart above is an area of trading that would represent much more bearish price action that trades below the current bear down channel. Today we see that the market rallied back up to underside of up trendline and failed badly on high volume… This is a bearish sign.

Now look for price action to resume back in the down channel and then work itself into an opportunity to bust below the down channel.

Once again I continue to be utterly fascinated with the Marty Armstrong Cycle Model Turning Point!!! It seems to be working again at nailing an important turn in the market 8.6 years after the previous one! Wow!

It is still too early to tell, but we could be on the verge of a massive down cycle into end of 2011, perhaps coincidental with the Maya Cycle End Date later this year.

Good call on your neutral BOT yesterday. Today I lost most of what I had made the previous 4 trading days. Should have taken more profits yesterday. Hard to believe this big drop today was based on a few economic reports, especially the ADP, which is usually inaccurate. Would have to wonder what went down between Obama and the Republicans had anything to do with it.

As I posted here before I think at some time the market will no longer get the backing of the FED which could cause a fall in most all asset prices. Bernake knows QE3 is not politically acceptable but if he waits long enough people will be begging him for QE3. And of course that will be the death knell for this country’s standard of living.

Armstrong does correlate with the Bradley turn date of 6/15 For those who are not familiar with it

http://forbestadvice.com/Money/Gurus/DonaldBradley/BradleyTurnDates2011.html

Quantitative Easing is just crack for this market. Over the long run it has no real effect on the economy except for higher prices. An economy will eventually revert back to its natural or real level of output in the long run. Criminal Bernanke knows this but I don’t think he cares. Obama wants to get reelected so the powers that be will do everything they can do inflate the market to try to create a false sense of recovery. As much of a failure as it has been, one must admit that QE does lead to a higher stock market. A higher market= more votes for obama. Therefore, QE 3 is not out of the question. It’s sad that politics has to dictate monetary policy. So Don’t be surprised if the Friday job numbers come out “better than expected”. You better believe that someone with an eraser is doing some work on those numbers after today’s sell off. But the sad truth is this isn’t a recovery. We need jobs, jobs, and more jobs. The real effects of all these easy monetary policies will be felt by the average person a couple of years down the road. As I’ve written before, I’m following a bearish monthly pattern on the s&p that could lead the SPY all the way to mid 40 level if it plays out. Considering the high jobless rate, high debt levels, high food/energy prices/ and a debasing currency, we’re brewing up a perfect storm. I hope the pattern doesn’t play out, but things are so perfectly in motion that it is scary. Sooner or later we have to take our medicine to come out of this recession. All these monetary policies are just shielding the real problems if not exacerbating them.

Yes RMT, the dollar keeps getting crushed. I wonder how ugly this is going to get again… the money printing does not seem to have been effective.. so maybe now finally comes the real pain? They will still try to prop up the market, but I am still wondering when/if we will get run away hyper inflation… I guess it is taking so so long that it seems like it will never get there..