The Nasdaq Composite appears to be on a mission for 2850 to 2900 range, possibly in blow off or parabolic fashion. The nasdaq today did a key reversal hammer after a several week consolidation and could imply a big move up that kicks off tomorrow.

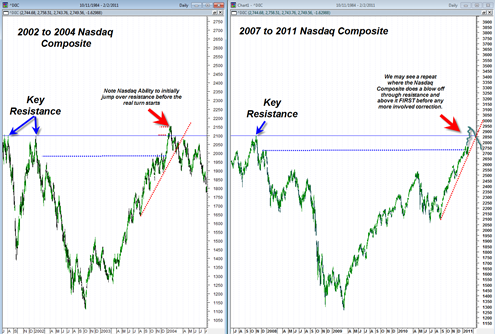

I am considering the possibility that the nasdaq will ‘run’ to the 2850 resistance range that correlates with the 2007 all time high and then ‘jump’ over it briefly before eventually succumbing to the supply in that range. This is my speculation for now based on the current ‘unstoppable train’ like strength of this market.

The Jakarta composite index did this when it got up to its old high and the nasdaq composite index did this previously during the 2003 to 2004 recovery rally after the war started in Iraq.

There are a lof of potential explanations for this, but one that makes sense is the existence of large amounts of stop orders at previous high ranges that at first get hit and cause an initial up surge right through the resistance level but then eventually whimper out and lead to a more involved sell off or correction.

The 2003 to 2004 example is a great reminder that we should always view resistance levels especially on indices as general ranges and cannot expect them to turn tail precisely at previous resistance level swing highs, such as the one in 2007.

I think the bears will eventually get the correction they are waiting for, but it may take another month or two of price action in my opinion based on the look of the chart above.

The nasdaq does not have to get all the way up to the 2007 peak before reversing but it probably will given current momentum and still current strength of the market.