I am a bit frustrated with the stock market indexes right now. In fact to be honest with you I am sick of them. There are still opportunities on the long side on plenty of individual stocks (Las Vegas Sands Corp is one of them), but in my opinion it is too late to jump into the long side of any indices, even if they do go to 1200 to 1250 on the SP500.

Where is the risk reward ?

The risk to reward ratio on the indices right now seems like it is close to 2 to 1. Two ounces of risk for every ounce of reward.

Now as far as the short side of the market and the inverse ETFS such as the Direxion Daily Small Cp Bear 3X Shs (TZA) ETF, it would seem that this inverse ETF still offers some good risk reward to the upside. But the problem is that today’s close in the indices was still more of the same. Inching higher like slow water torture 1 point, 1 day at a time for the next 30 days. That trading dynamic can go on for a long time and to be honest I don’t know when it will stop.

So that means that despite the apparent good risk reward in the inverse bear ETFS, unless they start performing from the get-go next week, it will be more of the same as their inverse dribble down relationship mirrors the dribble up move of broad market indices.

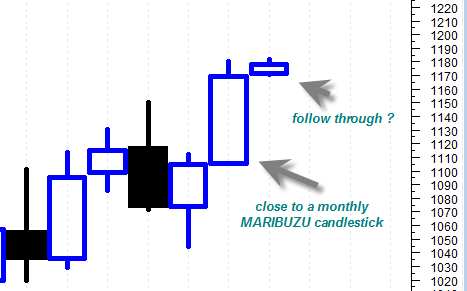

The monthly March closing candlestick on all the indices was a very strong closing candlestick and I believe it was almost a MARIBUZU candlestick, but not quite. A MARIBUZU candlestick exists when the opening price is exactly equal to the low of the day and the closing price is exactly equal to the high of the day. In this case we are talking about the monthly March closing candlestick and it did not close near the high of the month but it was close. The maribuzu basically means that the bulls are in total control of this market.

The monthly March closing candlestick on all the indices was a very strong closing candlestick and I believe it was almost a MARIBUZU candlestick, but not quite. A MARIBUZU candlestick exists when the opening price is exactly equal to the low of the day and the closing price is exactly equal to the high of the day. In this case we are talking about the monthly March closing candlestick and it did not close near the high of the month but it was close. The maribuzu basically means that the bulls are in total control of this market.

The close today on the NYSE New York Stock Exchange index ( a very broadly diversified index) was very strong today and did show a very strong closing daily candle for the first day of April. It is very hard to argue with that kind of strength coming off of the previous month which was already a near MARIBUZU candlestick.

To me it means we are probably going higher in the broad market, maybe for most of April. Unless by some miracle the indices fail badly early next week and also the NYSE index breaks down badly again and closes below 7450, then I have to say the bulls still have it and the trickle up continues.

Where is the Best Risk Reward Right Now?

It could very well be that the best risk reward right now is in the precious metals ETFS. There still needs to be solid confirmation of this, but my close watching of the group is telling me we are getting closer and closer to a new uptrend leg of 1 to 3 months duration.

The fact is that the gold price did a massive LIFETIME breakout to new all time highs in the September 2009 period. That was 7 long months ago which is an eternity in terms of trading time.

But can we say that about the stock market as well? No! The stock market, although rallying very strongly and persistently since the March 2009 lows has as of yet not even come close to hitting new all time highs. A decent number of individual stocks have been hitting new lifetime all time highs but not the indices themselves.

So that tells me that the gold price is the leading asset and the one that has moved the highest and the fastest as a result of the massive inflationary money printing. The stock market has not, but it is attempting to and is playing catch up right now.

In the final analysis what will probably happen is that you will probably see the stock market work its way back up to or near the 2007 highs (at least attempt to anyway) and by that time the gold price will already be screaming to new record highs. Then inflation headlines will probably start hitting the wires and it will burst the stock market rally and finally cause it to top out, but then gold will spike even higher in a final blow off rally as the stock market declines again.

Gold is probably the best risk reward right now because it has been declining since December 1st 2009 and has built a lot of sideways cause and put it in a position where it could catapult and get a new rally leg going leading the inflationary banners higher.

But, for timing purposes the GLD SPDR Gold Trust still needs to get to and above the 114 level for me to become fully convinced that it is ready for prime time.

The iShares Silver Trust (SLV) needs to get above 19 and change for me to also say that it is ready for another big leg higher. Silver is still playing catch up to gold but has a very large pattern which may point to an eventual 10 dollar move higher in the year or 2 year period ahead. The weekly chart on the iShares Silver Trust is showing a large head and shoulders bottoming formation but as of now there is no breakout indication. That indication may come on a move above 19 and change.

Incidentally the Market Vectors Gold Miners ETF (GDX) sports a pattern that looks very similar to the large weekly head and shoulders bottom formation on the iShares Silver Trust . The measurement projection on the Market Vectors Gold Miners ETF GDX points to roughly 80 level which would be a huge move and would mean that many individual mining stocks would probably go ballistic.

But these potential moves, if they occur are going to take a lot of time to manifest themselves because we are talking about such huge patterns.

So heads up on the precious metals sector!

It is still early and key levels are not reached yet for me to say ‘Its time’ but I believe we are getting close and this group is potentially a much better risk reward right now than anything else I am aware of.

More on this sector as it develops…

Sounds right on the money. I must admit I have been distressed by this market as well. I am not a trader but a long term investor and today marked my long term capital gain in DDM 116% YES!! so Monday will be a relief for me. I have made some excellent positions in divy stocks and like you Tom just waiting to get something concrete to happen. I will be watching PTM a bit more than GLD because i don’t like to follow the crowed all to often. But wont touch the indexes again until we get something to work with. The RSI on the index’s is ridiculously high and the VIX is looking for a reason to break out. Humm interesting no doubt.