Once again the bulls completely own the show and gapped the market up today and closed very strong and on pretty healthy volume at least compared to what we were seeing before.

I once again refer you to this chart of the SP500 that shows we still have some time left before we actually hit the longer term down trendline. And as was seen in the 1975 period, even if we do hit the down trendline there is at least the possibility that we will blast right through it initially only to consolidate for a while and then eventually turn down.

Blasting through that down trendline at least initially, would weaken that bear market force and warn that even if we do get the eventual 15% correction, we are likely to blast higher sometime next year after the consolidation.

You just have to give the bulls the benefit of the doubt going into the end of this year. We are half way through October and the monthly price bar is still looking quite bullish for October. When the bulls realize there will be no crash in October they may just ramp the market up even higher in the form of a ‘relief rally’. It seems all the scared money is now coming into the market, the money that was waiting on the sidelines to see if this rally was for real.

The daily RSI (Relative Strength Index) on the Sp500 right now is very close to the 70 level and if it is once again able to break through 70 it would put the market into the ‘power zone’ of unstoppable confidence.

I continue to repeat my longer term forecast that I expect the market to ‘only’ do a 15 to 20% correction when it finally arrives. Then some sort of sideways to slanted down corrective process that may last 6 to 8 months. And then an eventual upside resumption.

When I look at many individual stocks and also many of the cheaper stocks in the real estate and retail sectors I can see that they have long bases and are coming off of these bases on heavy volume and have nice uptrend patterns. I am not saying that these cheap stocks are the leaders of the market, but if you look at the charts going back one or two years, it just does not make much sense to conclude that they will just crash and burn after such a technical pattern.

In some of them it looks like a ‘rounding bottom’ technical pattern or saucer bottom in some cases. They depict a situation where they just keep climbing higher and higher on an gradual economic recovery, perhaps even close to their all time highs.

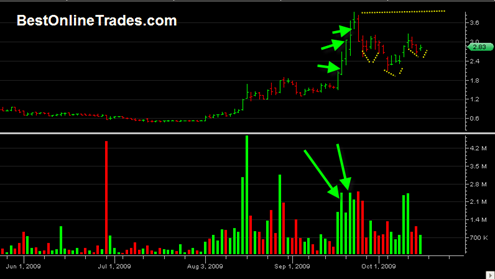

TA Travel Centers of America is a great example. I mentioned this stock a few days ago and today it had a nice breakout but the volume was slightly shy of the previous high volume swing of a month ago. Nevertheless the stock had a beautiful pattern and clean chart. It was one of the cleanest looking charts and setups I have seen in some time. It looks on track to make it to about 10 and change as there is little resistance from here to that point.

So TA is a great example of how you can still make a profit with carefully controlled levels no matter how ‘high’ the overall market is and you are maybe scared to get in. Now if Intel had come out with horrible earnings it probably would have tanked the market and maybe TA would have formed some kind of double top… but this was clearly not the case today. The bulls still have the ball.

If you missed TA, then NCT may be next up in line for a breakout type move. NCT is NewCastle Investment Corp and is in the real estate sector. I like the bullish volume price advances on wide price spread. It shows that the bulls are in control. In particular the action in mid September was really positive and shows who is controlling this stock. And then the two price advances about 5 trading days ago on similar very heavy volume. The bulls want to run this stock and I suspect they are going to get their way.

There appears to be a mini head and shoulders bottoming formation over the last 15 trading days or so. I would expect NCT to jump higher again possibly starting as soon as tomorrow and then getting a run back to 4.00 to test the highs again.

A nice trending price advance in NCT and nice price action on the rebound from the recent correction. So NCT similar to TA is a play on the overall economic recovery in retail and real estate. Both NCT and TA could keep trending higher and higher into the end of the year but for the purposes of this post I am just pointing them out as trade setups.